Gavin Parnell, Director of Go Supply Chain Consulting Limited, considers the growth of the UK automotive industry, and the associated logistics challenges

Right now, the consensus is that the outlook for the automobile industry in the UK in the next five years is great. It has been a slow recovery since the end of 2009 when the industry hit a real low, producing just over R1m vehicles that year.

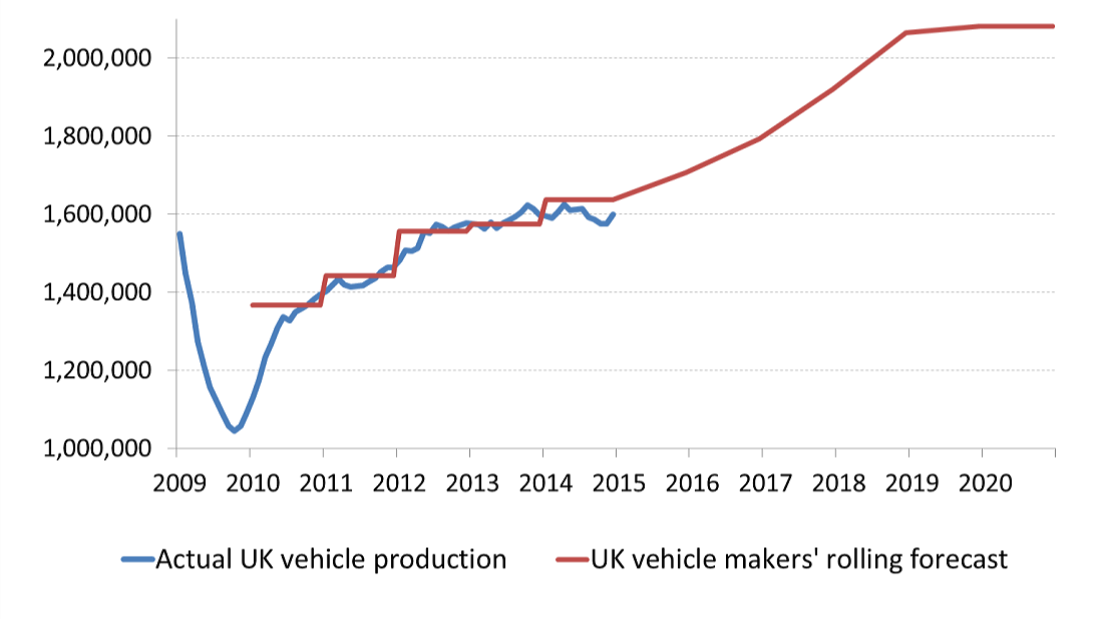

Mike Hawes, chief executive of industry body the Society of Motor Manufacturers and Traders (SMMT) proudly speaks of an “automotive renaissance” when describing the industry in 2015. According to the Automobile Council UK, we will reach an output of two million new vehicles within 3 – 5 years.

UK vehicle output in units – forecast volumes until 2020

Source: “Growing the Automotive Supply Chain” Automotive Council UK, March 2015

There will be a direct and mostly positive impact on automotive supply chains. We can expect organic growth throughout the sector, creating jobs and economic opportunities for current and emerging suppliers. However, there will be new challenges to address in many areas including vehicle assembly, transportation and the expanding after-market.

The industry is buoyant

In 2014, the original equipment manufacturers (OEMs) built over 1.6 million vehicles and 2.5 million engines, exporting over 80% of UK production. OEMs are creating a demand for advanced technology features, and premium materials and finishes. Modern vehicles are made up of more than 30 000 component parts; the demand for these will especially benefit the industry’s Tier 2 and Tier 3 suppliers.

“On-shoring” of production of component parts

OEM companies need to create more reliable and shorter supply chains, both for manufacturing of new vehicles and for the distribution of after-market products. The trend is towards “on-shoring” of production of component parts from Europe that will reduce lead times, improve responsiveness of suppliers and reduce logistics costs.

These developments will create new supply chain challenges in distribution centres, warehousing and inventory, sub-assembly and transport logistics.

Vehicle assembly lines

“Carmakers are looking carefully at ways to simplify inbound logistics to assembly lines, including kitting operations and, in some cases, in-sourcing,” says Christopher Ludwig in a detailed article in Automotive Logistics Magazine. He notes that “there is a move away from sequencing directly to the line in favour of kitting, as well as a tendency to keep more of these operations in-house, rather than outsourcing them to tier suppliers or logistics providers”.

Communication from the manufacturing line defines the need and the supply of component parts to the assembly area. Just-In-Sequence (JIS), a strategy also referred to as in-line vehicle sequencing (ILVS), attempts to ensure that components and parts arrive at a production line only as and when required. However, some actual production sequences cannot be planned ahead of time or may need re-work. What can we do to improve the activities in sub-assembly and limit any delays?

Aftermarket and the customer

Increased consumer demand for speedy and quality maintenance services raises issues for the after-market for replacement components and parts. OEMs generate about half of their profit from aftermarket service parts, so being able to deliver faster than the competition and supporting their dealerships is vital. It seems that too little focus is given to after-market distribution processes and systems despite the critical impact on customer services and the potential for cost savings.

Some of the questions we need to answer in the aftermarket are:

- How do we design and plan warehouse operations?

- How do we reduce transportation costs?

- Do we use a distribution warehouse, or can we do direct deliveries from suppliers?

- How do we speed up the time-to-market?

- How do we manage emergency requirements?

Manufacturers and distributors need sophisticated IT systems to track sales of items, who is buying what, which channels are being used and most importantly, what is not moving and why.

Transport and Logistics

Automotive manufacturers traditionally establish strong partnerships with third-party logistics and transport service providers (3PLs) to manage their deliveries. Transporting vehicles and valuable parts is a specialised and high-risk activity best managed by experts due to the potential for theft, damage, fraud and time-consuming management of both drivers and equipment. Exporting vehicles to Europe is complicated due to having to manage multiple modes of transport and working with EU regulations, particularly on road logistics.

More and more OEMs are asking their 3PLs to become lead logistics providers (LLPs) and take over many of the non-transport activities they used to do themselves, such as cross-docking, inventory management and warehousing. The LLPs can become trusted partners and therefore, an extension of the OEM’s operations.

There no doubt that the mini boom we are seeing in the automobile industry is beneficial to the UK economy in many ways. Are your supply chain operations able to cope with the expected growth in volume and complexity?

Gavin Parnell is a Director of Go Supply Chain Consulting, a specialist in optimising logistics in automotive supply chains.

Please click here to contact one of our logistics consultants

Image Credit: “FreeImages.com/Simon Reading.”