The UK economy is experiencing the highest inflation in decades. The rate of inflation is the change in prices for goods and services over time. Measures of inflation include consumer price inflation, producer price inflation and the House Price Index.

When prices rise, supply chains carry the main burden with the main impact on labour, transport and energy costs. Everything costs more, not only goods but services too. Prices increase because prices are increasing, inflation is cyclical.

What is driving inflation?

Since 2020 the pandemic has increased the demand for goods, closed factories, created port congestion and disrupted supply chains. All of these converge to lead to higher prices which have been further impacted by a rise in consumer spending.

Recovery is slow, impacted by the scarcity of labour, partly due to Brexit. The disruption in natural gas and oil flows from Russia because of the war in Ukraine is likely to continue. Energy price increases are driving up transportation and freight costs that were already on the rise because of the ongoing driver shortage.

The ongoing shortage of microchips is one example of how a lack of enough raw materials and transport delays created a knock-on effect on the availability and prices of new vehicles.

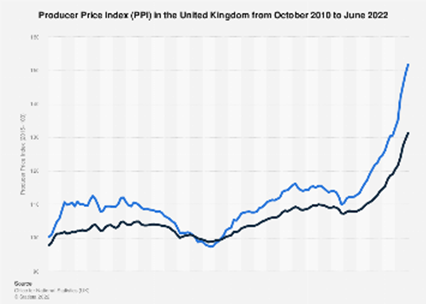

The Producer Price Index (PPI)

The PPI is one of the three main indicators used to measure inflation. It tracks changes in the prices of goods bought and sold by UK manufacturers, including price indices of materials and fuels purchased (input prices) and factory gate prices (output prices).

- Producer input prices (purchases) rose by 24.0% in the year to June 2022, up from 22.4% in the year to May 2022; this is the highest the rate has been since records began in January 1985.

- Producer output (factory gate) prices rose by 16.5% in the year to June 2022, up from 15.8% in the year to May 2022; this is the highest the rate has been since September 1977.

- Metals and non-metallic minerals, and food products provided the largest upward contributions to the annual rates of input and output inflation, respectively.

- Services producer prices rose by 5.4% in the year to Quarter 2 (Apr to June) 2022, up from 4.2% in the year to Quarter 1 (Jan to Mar) 2022; this is the highest the rate has been since records began in Quarter 1 1999.

ONS (2022). Inflation and price indices – Office for National Statistics. [online] Ons.gov.uk. Available at: https://www.ons.gov.uk/economy/inflationandpriceindices.

How inflation affects supply chains

Input costs vary by industry sector, but all are affected by energy costs and wages. The greatest impact is felt in raw materials and operational costs in production including fuels, labour, warehouse logistics and transport. As input costs rise, prices follow. Supply chain instability and disruption are likely to continue throughout 2022. Economists suggest that there may be some respite in 2023. Fuel and gas prices are not expected to come down any time soon. As transport costs increase, who will pay for the additional costs, the manufacturer, the distributor or the customer? It may be possible to pass some of the extra cost to the customer in the short term but retaining customers means absorbing much of it.

Combatting inflation in the supply chain

To withstand the impact of rising input prices we need to be more efficient and find ways to manage our business differently. Operational costs need to be controlled without sacrificing product or service quality.

Areas of opportunity include:

Supplier relationships

- Revisit current supply contracts to find ways to limit inflation risk. Look for price increase provisions in existing contracts that include escalations or fixed price increases that are not linked to inflation.

- Inflation-proof any new contracts to mitigate against future risk

- Consider reducing product range and variety to increase volume, opening an area for negotiation.

Product innovation

- Modify designs or specifications to use cheaper or fewer materials e.g., packaging

- Look for alternative sources of supply of key components

- Consider different manufacturing alternatives e.g., 3D printing

- Direct customer demand toward more affordable or readily available options.

- Volume aggregation and consolidation of supply lead to better pricing, fewer suppliers and simpler supplier management.

Labour

Labour costs can be reduced through the more widespread use of automation in the warehouse. Companies who have reduced human transit time, either through better physical layout or through part-automation have managed to reduce their need for more employees.

In the longer term, more automation and technology solutions will deliver cost savings that will mitigate the impact of rising inflation. Digital solutions can provide visibility throughout the supply chain from spend analytics through all manufacturing and warehousing processes to the final delivery to the customer. Cost savings are achievable at every stage.

Find out more about How to combat the inflation in Logistics and Warehousing, in Part 2 of this article.

Throughout the years, SCCG has been helping companies to find a way to deal with different challenges, find the best solutions and showcase a suitable plan for growing a company that faces shortages and increased prices.

At SCCG, our consultants are professionally trained to help a business find the right solution and combat the negative effect of inflation. Improving both data and inventory, finding a suitable plan to optimise a warehouse or reviewing a tender contract, would be just a few services we offer in terms of Supply Chain and Logistics.